An exception to this rule is when an asset is disposed before its final year of its useful life, i.e. in one of its middle years. In that case, we will charge depreciation only for the time the asset was still in use (partial year). Like in the first year calculation, we will use a time factor for the number of months the asset was in use but multiply it by its carrying value at the start of the period instead of its cost. Since the assets will be used throughout the year, there is no need to reduce the depreciation expense, which is why we use a time factor of 1 in the depreciation schedule (see example below). After the first year, we apply the depreciation rate to the carrying value (cost minus accumulated depreciation) of the asset at the start of the period. We can incorporate this adjustment using the time factor, which is the number of months the asset is available in an accounting period divided by 12.

Sum of Years’ Digits Depreciation

The DDB method involves multiplying the book value at the beginning of each fiscal year by a fixed depreciation rate, which is often double the straight-line rate. This method results in a larger depreciation expense in the early years and gradually smaller expenses as the asset ages. It’s widely used in business accounting for assets that depreciate quickly.

Double Declining Balance: A Simple Depreciation Guide

- Since the assets will be used throughout the year, there is no need to reduce the depreciation expense, which is why we use a time factor of 1 in the depreciation schedule (see example below).

- Instead, compute the difference between the beginning book value and salvage value to compute the depreciation expense.

- By front-loading depreciation expenses, it offers the advantage of aligning with the actual wear and tear pattern of assets.

- Double Declining Balance (DDB) depreciation is a method of accelerated depreciation that allows for greater depreciation expenses in the initial years of an asset’s life.

The double-declining balance (DDB) method is a type of declining balance method that instead uses double the normal depreciation rate. When changing depreciation methods, companies should carefully justify the change and adhere to accounting standards and tax regulations. Additionally, any changes must be disclosed in the financial statements to maintain transparency and comparability. Generally Accepted Accounting Principles (GAAP) allow for various depreciation methods, including DDB, as long as they provide a systematic and rational allocation of the cost of an asset over its useful life.

Calculating the Depreciation Formula for DDB

Calculating the annual depreciation expense under DDB involves a few steps. First, determine the asset’s initial cost, its estimated salvage value at the end of its useful life, and its useful life span. Then, calculate the straight-line depreciation rate and double it to find the DDB rate.

Declining Balance Method of Assets Depreciation FAQs

Now you’re going to write it off your taxes using the double depreciation balance method. (An example might be an apple tree that produces fewer and fewer apples as the years go by.) Naturally, you have to pay taxes on that income. But you can reduce that tax obligation by writing off more of the asset early on. As years go by and you deduct less of the asset’s value, you’ll also be making less income from the asset—so the two balance out.

Understanding how to calculate and apply this method can provide valuable insights into asset management and financial planning. In the world of finance and accounting, understanding how to manage and account for asset depreciation is crucial for all businesses. Imagine being able to maximize your tax deductions and improve your cash flow in the initial years of an asset’s life.

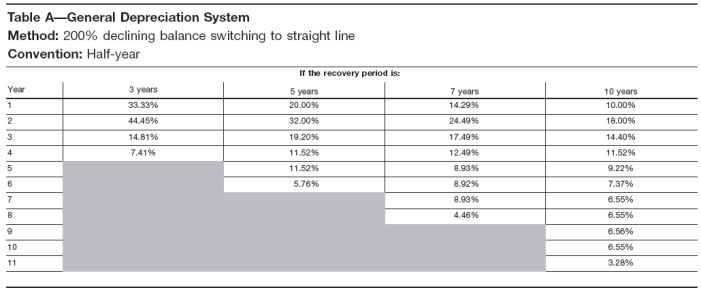

Financial accounting applications of declining balance are often linked to income tax regulations, which allow the taxpayer to compute the annual rate by applying a percentage multiplier to the straight-line rate. Because the equipment has a useful life of only five years, it is expected to lose value quickly in the first few years of use. For this reason, DDB is the most appropriate depreciation method for this type of asset.

The DDB method is particularly relevant in industries where assets depreciate rapidly, such as technology or automotive sectors. For example, companies may use DDB for their fleet of vehicles or for high-tech manufacturing instructions for form 5695 equipment, reflecting the rapid loss of value in these assets. We now have the necessary inputs to build our accelerated depreciation schedule. Suppose a company purchased a fixed asset (PP&E) at a cost of $20 million.

Leave a Reply