ETFs generally song a certain field directory, market, item, or other resource group, getting traders with exposure to a varied list of securities inside the just one money. Their benefits are liquidity, straight down expenditures than just common fund, variation, and you can tax advantages. However, instead of ETFs, mutual fund commonly exchanged for the inventory transfers. Rather, a broker generally facilitates buy and sell orders between people and you will the newest financing director. Within not-being change-replaced, common financing are just priced just after each day following business shuts, in line with the underlying security rates. Including shared financing, they give traders a desire for a professionally handled, diversified portfolio out of assets.

Other actions tend to be having fun with put alternatives for hedging or combining possibilities to possess certain exposure and you will return users. These types of ETFs fool around with economic types such as futures, options, and you will swaps to get to their requirements. Such as, the fresh Direxion Everyday Monetary Bear 3x Shares (FAZ) are a triple incur finance. They attempts to move three hundred% in the value in the opposite advice of your Monetary Come across Business List. They uses derivatives or other form of power to improve their performance production.

Label choices allow the holder the right to get a secured item in the struck rates within a specific time frame. Place alternatives allow the owner the ability to sell the underlying resource in the strike speed in this a particular time period. This type of purchase a portfolio away from REITs, providing you with exposure to the real property field without the need to get characteristics personally.

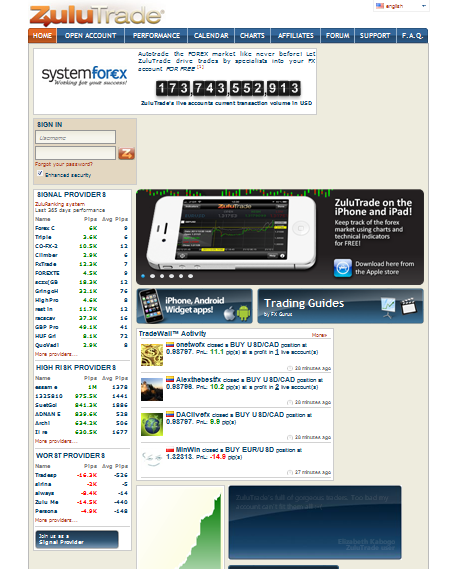

Exchange-Traded Fund (ETFs) have cultivated exponentially in the popularity over the past few years, delivering people with a versatile and value-efficient way to achieve experience https://travelplugkenya.co.ke/2025/09/08/fiscalite-trading-le-guide-complet-pour-votre-declaration-2025/ of some locations. This article usually familiarizes you with the basics of ETF trade, outlining what ETFs are, how they works, and how you could start trade them. Swinging after that down we do have the Overall performance point and that just after prolonged gets the individual for the short-term to long lasting production increasing to the ten-years if the offered. Prior to making a good investment decision, believe how the type of ETF you’ll feeling your portfolio and just how they compares to other types of financing. You can get and sell ETFs thanks to a broker membership by the just setting a buy otherwise promote purchase, just as you would for other holds. Make Service away from Labor’s extension of the fiduciary code inside 2016, demanding brokers to adhere to the same standards as the advisers.

Just how Try a keen ETF Different from a collection Money?

However, knowing its key variations can help people decide which might getting best for him or her. The fresh distinction of being the initial exchange-exchanged finance (ETF) can be given to the fresh SPDR S&P five hundred ETF (SPY) released from the Condition Road Worldwide Advisers for the Jan. 22, 1993. There have been, however, certain precursors to SPY, and List Participation Devices listed on the Toronto Stock-exchange (TSX), which tracked the brand new Toronto thirty five Directory and you may starred in 1990. To the Friday, the firm announced a good $21 billion at the-the-industry (ATM) providing of its Show A favorite inventory (STRK), the fresh continues that would be primarily familiar with finance fresh BTC sales. Technique is the newest world’s biggest social-detailed bitcoin holder, featuring a money hide out of 499,096 BTC ($40.cuatro billion).

Regularity in leveraged long and short ETFs has increased sharply.

That it exposure is generally made worse throughout the times of industry fret if the the fresh trading frequency to own an enthusiastic ETF minimizes, in the event the more people want to offer instead of buy an ETF’s offers and other grounds. Some of these causes can lead to a trader promoting the shares in the a great “discount” to what the newest ETF’s fundamental holdings are already well worth. Actively managed ETFs utilize a financing manager which protects the brand new standards the fresh finance tracks.

Inverse ETFs are created to move around in the exact opposite guidance from the new directory they song. This tactic relates to continuously investing a predetermined amount of money to the ETF change, regardless of the industry’s performance. Through the years, this helps balance out the results out of field volatility and you can reduce the threat of to buy at the business highs. Over the past 5+ many years, Ms. Allen might have been doing work closely with financing places desks, list business, and collection executives to bring the new ETFs to sell. More recently, she is purchased enabling enable traders to feel positive about the investment options due to ETF education. Ms. Allen hosts the brand new per week ETF Field Expertise broadcast, getting ETF knowledge to Doing it yourself buyers inside the a clear and you may to the point manner.

A common simplification is that ETFs have a tendency to tune list fund when you are common money are usually actively treated, nevertheless should not suppose that is always the case. Just as in stocks, you may need to shell out a deal commission to your broker per ETF change. You to percentage, although not, is special to the brokerage, rather than being something that the fresh ETF accumulates. Alternatively, ETFs provides a share-based yearly payment, such as shared finance, labeled as an expense ratio. Most ETFs are designed to song, or make an effort to fits, the newest overall performance of an industry list, smaller the new financing’s costs. There are various market indicator of all the categories; they may tune mid-sized organizations, international stocks, funding degree securities otherwise layouts including fake intelligence otherwise sustainable spending.

These people were acknowledged underneath the idea that futures segments be a little more managed which means provide highest degrees of individual protection than simply put cryptocurrency areas. Sure, so long as the root brings stored in the ETF spend returns. These firms’ dividends are gathered because of the ETF issuer and shared with buyers, generally quarterly, in accordance with the amount of offers the brand new trader is the owner of from the ETF.

- Whenever common money transform the holdings, any winnings from attempting to sell opportunities are believed “funding development” and so are taxed.

- Extremely ETFs are created to track, or you will need to matches, the brand new performance of market index, quicker the newest financing’s costs.

- It ETF music natural gas prices by buying gas futures agreements.

- Inside the 1996, three-years following the introduction of SPDR, the original international ETF introduced.

Integration isn’t suitable for folks, so you should cautiously consider carefully your choices. From the Maverick Trade, we often highlight the newest wheel strategy to our students and you may players since it aligns well with a self-disciplined, long-term approach. By the rotating anywhere between cash-protected puts and you can safeguarded calls, the brand new controls means might help save some money basis for the stocks we should own while you are promoting typical choice premium. The modern stock rates takes on a crucial role within this choice-making techniques, because impacts the newest success and you will timing away from selling lay options and you may creating protected phone calls.

3 years following SPDR’s debut, the original worldwide ETF launched plus 2002 the original thread ETF was made found in the market industry. Over the past twenty-seven ages, how many ETFs has exploded as the gets the assets lower than government. Normally, effective fund professionals is focused within their individual field otherwise industry. That it changes in order to an energetic movie director who usually tries to beat the newest benchmark over a period of date but normally charge highest can cost you in order to do you to. Furthermore offered them the ability to buy places, places templates, groups as well as resource categories with one easy exchange. It’s an incredibly, efficient method of getting entry to a huge number of carries, bonds or products in one simple transaction.

Don’t forget about even if, you have still got to think about people purchase and you will child custody fees recharged by the financing provider. The things they’re doing are, it allow it to be all the buyers of all types the capability to invest in the worldwide segments without the need to do huge amounts of investigation on the private carries bonds, fund, otherwise potentially go through an advisor. He’s an easy to use, cheap and you may taxation effective way to spend currency and are accessible fee free of many on the internet broker membership and you will thanks to financial advisors. The convenience away from change ETFs offers people additional control more than when and how it trading. So it liquidity function is amongst the trick great things about owning ETFs, particularly if compared to the shared fund. One good way to see which fund are the most widely used is actually to consider individuals with by far the most assets lower than administration.

Take note the last price and day’s changes shown inside the newest overview point is actually a bona-fide-time quotation which can be rejuvenated because of the pressing here. Three ETFs were added to the list, but i have a 4th one that is the ishares S&P\TSX 60 icon getting XIU, and therefore I will enhance the equipment. Same as within our offer point, go into the ETF name or icon after which discover it. Now the brand new compare unit is ideal for taking a look at ETFs with similar expectations, or make use of it so you can evaluate nonrelated ETFs having different objectives, the choice are yours.